- Pre-Financing Stage

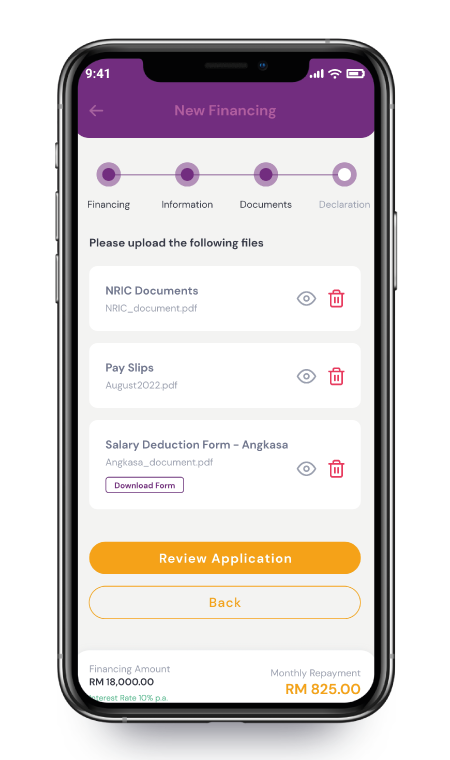

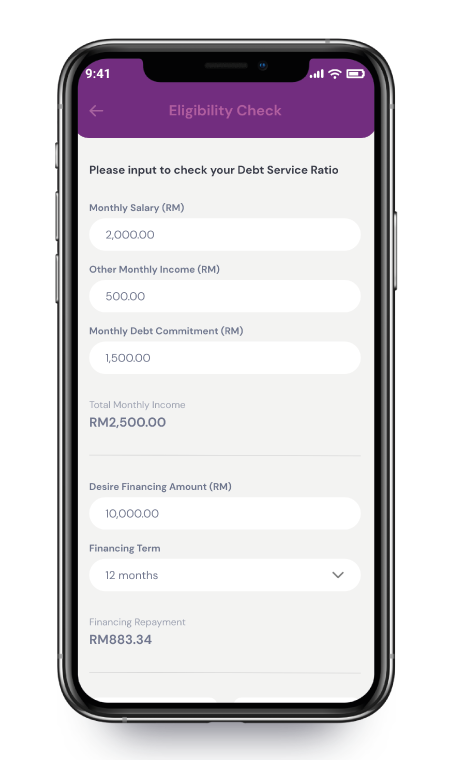

Run eligibility check with debt service ratio calculator, fill in e-form and upload all the necessary documents. - CCRIS Check

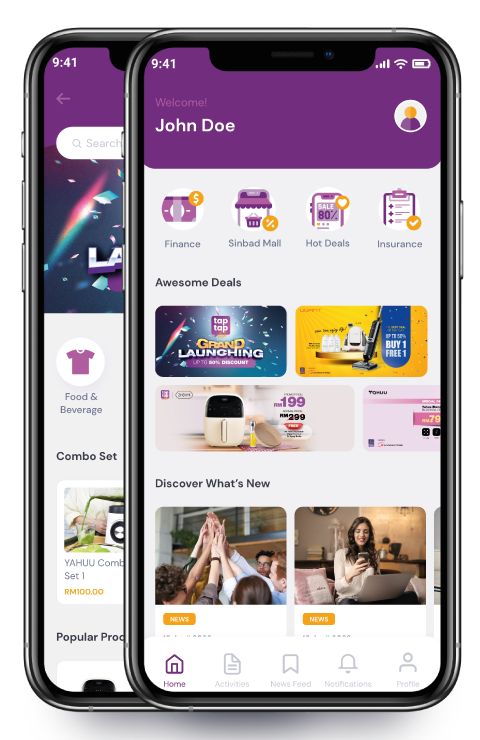

Run an instant scan for bankruptcy status of new members. - Financing Status

Periodically check on approval status of the Financing applied and the details. - Approval Stage

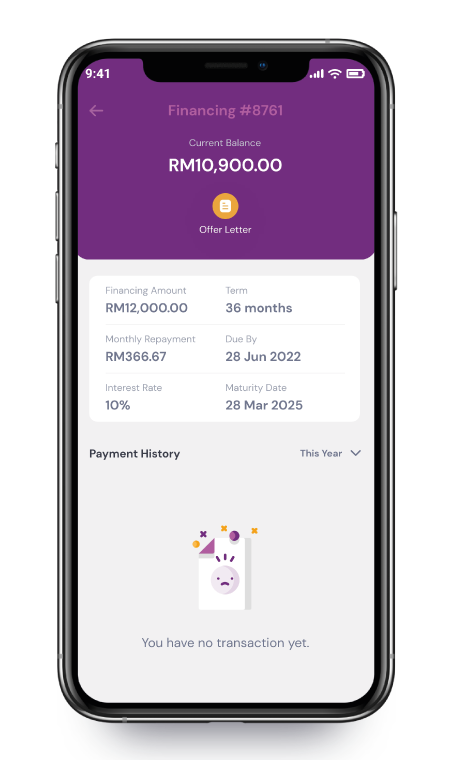

Monitor and manage approved finances as well as all view transaction history including payments made.

Membership Form

Apply for cooperative membership through the app with a straight-forward registration form.